Our clients at Revstep often ask us about the best way to extend sales into Canada and Mexico. They wonder:

- Can I fulfill from my US FBA stock to Canada or Mexico?

- Can I keep my prime badge if I use my own fulfillment center in Canada?

- What does it cost in duties and taxes when I ship inventory to Canada’s FBA fulfillment centers?

- How much inventory should I send for starters?

- Am I required to file sales tax in Canada or does Amazon do that for me like Amazon.com does?

- What should I do with international returns?

These are good questions with real financial consequences! Until recently, Amazon required sellers to send inventory to Canadian or Mexican FBA FCs (Fulfillment Centers) to offer prime shipping in those countries. Sellers have the option of using a 3PL (3rd party logistics) to store and ship your product, but that most often excludes them from getting the “Prime Badge” starting out in the new country. Well, have no fear – REMOTE FULFILLMENT IS HERE!

Remote fulfillment in a nutshell is a program that allows sellers with inventory in US FBA fulfillment centers to sell eligible inventory to customers in Canada and Mexico without having to store inventory locally in those countries. North American professional selling accounts automatically have access to a unified account, which allows you to manage offers in US, Canada, and Mexico from a single interface. You’ve most likely seen the dropdown marketplace option at the top of your seller central account home screen that allows you to toggle between marketplaces.

Amazon Wants you to Get Your Feet Wet!

A while back I received a call from an Amazon agent that invited me to start selling in Brazil from the US with a program similar to the new Canada/Mexico FBA remote fulfilment program. Upon receiving a Brazilian order, I had to 3rd party mail my product to an Amazon partner fulfillment center in Florida which would then airship it to Brazil. Ultimately, the cost (and headache) of multiple legs of shipping made selling in Brazil a net zero operation. In addition, the Brazilian Real to USD exchange rate was unbearable to most Brazilian shoppers and has only gotten worse since the pandemic. As you can guess, we bagged the idea. The good news is that North American countries don’t have as big of an exchange rate disparity and Amazon is offering better shipping rates with full-service support, including dealing with returns in other countries. Amazon wants you to grow and tries hard to eliminate any barriers that keep you from expanding to new marketplaces. Their VAT and translation services, however, are sub-par in our opinion – you don’t need translations from English to new languages, you need keyword optimization built from scratch. For example, the word “stroller” in US listing might be translated as a Kinderwagen, a Spazierganger, or a Sportwagen. Amazon translates listings about as well as google translate does, which may or may not use the most common phrases in that country. What’s my point? Not all of Amazon services are effective, but they want to help you grow so they can grow. The remote fulfillment program is a productive service to get your feet wet in a new country.

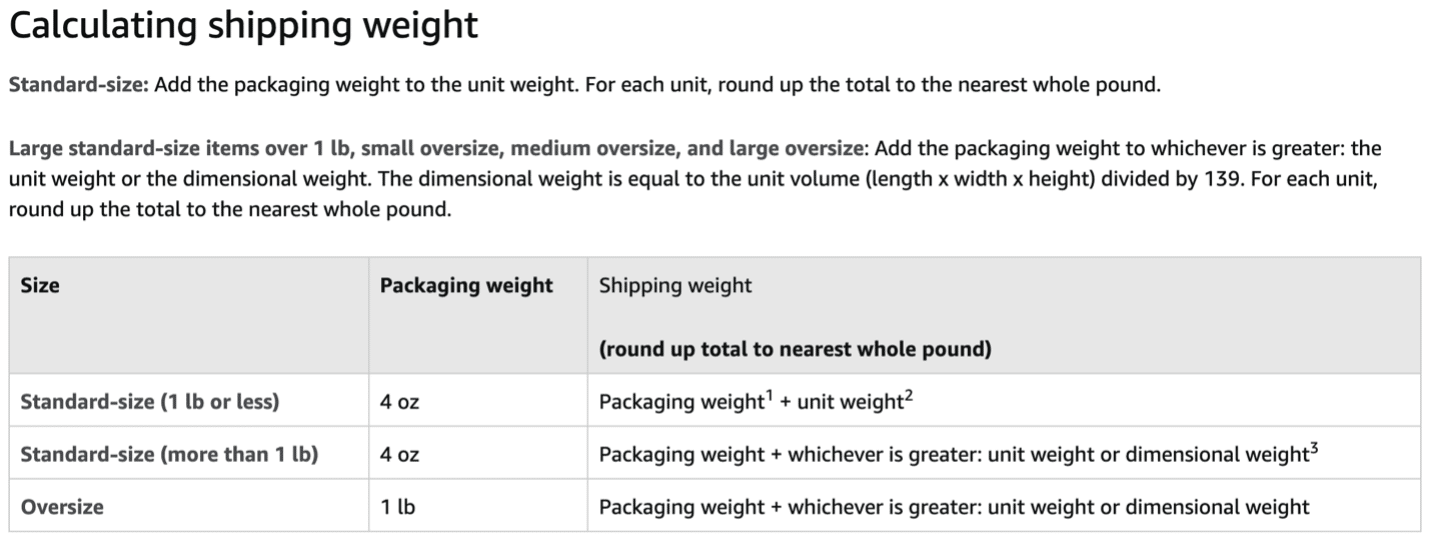

What does FBA Remote Fulfillment Cost?

According to Amazon, “Remote Fulfillment sales incur higher fulfillment fees to account for the costs of cross-border fulfillment to Canada and Mexico. Remote Fulfillment fees apply year round and replace the standard fulfillment fees in Canada and Mexico. Standard US fulfillment fees apply for sales on Amazon.com. Referral fees are based on the marketplace where the item was bought.”

Here is the cost breakdown of cross-border remote fulfillment with FBA:

How does Amazon Manage Import Duties via Remote Fulfillment?

While prime customers get free shipping to Mexico (5 to 9 days) or Canada (7 to 12 days), they must pay the import duties; sellers are off the hook on collecting and paying these fees. Duties are not always straight-forward. Even Revstep, as a bonded importer, hires a customs broker to comb through thousands of HS Codes to determine the right duties to pay upon entry into the US. Luckily Amazon simplifies this for you and charges the customer an estimated deposit for import duties and VAT on your behalf. As soon as the customer purchases the item, they assume ownership of it and therefore become the importer of record (the person responsible to pay the duties and taxes). Amazon adds the import fee to the amount the customer pays at checkout. At that time, the customer also authorizes international carriers to pay this amount to the Canadian or Mexican authorities on their behalf.

What to do with Canadian and Mexican returns?

Amazon offers a very basic answer that says the same FBA customer returns policy applies and the returned items will be sent directly back to the US like any normal US purchase. True cost is yet to be seen. We will update the blog when we have a clear answer.

Remote Fulfillment is a Good Idea!

In entrepreneurship we talk about the MVP – Minimum Viable Product. Amazon is offering sellers an opportunity to use their Minimum Viable Process. In a book I recently read, “The Lean Start-up”, Eric Ries describes an MVP as a version of a new product (or a process in this case) that allows managers to maximize learning about customers with the least effort and capital expense. So before you spend exorbitant money on a new idea, test the market and understand what kind of demand and sales opportunity there is. I believe remote fulfillment is the minimum viable process for sellers to enter a market because:

- It’s immediate – no need to reallocate inventory or waste processing time

- You still receive the prime badge

- It eliminates some of the immediate cost of selling internationally

- Amazon minimizes your effort by processing taxes, duties, and returns on your behalf.

If your products don’t sell well in the new marketplace or you don’t have enough margin baked into your price, you can just as easily turn them off as you turned them on. If the products do well in the new country, our recommendation is to send bulk inventory directly to that country’s Amazon FCs so you can both offer 2 day prime shipping instead of the delayed international prime shipping and also minimize the higher international FBA fee. So go one, give it a try and your product sales might surprise you!